Title

Key Figures

Expert in the management of mutual funds in Morocco, discover some key figures about us : key dates, number of employees, volume of assets under management...

in asset management in Morocco

billion MAD of AUM as end of January 2026

years of experience in the asset management field

shareholders: Attijariwafa bank and Amundi

distribution networks

employees

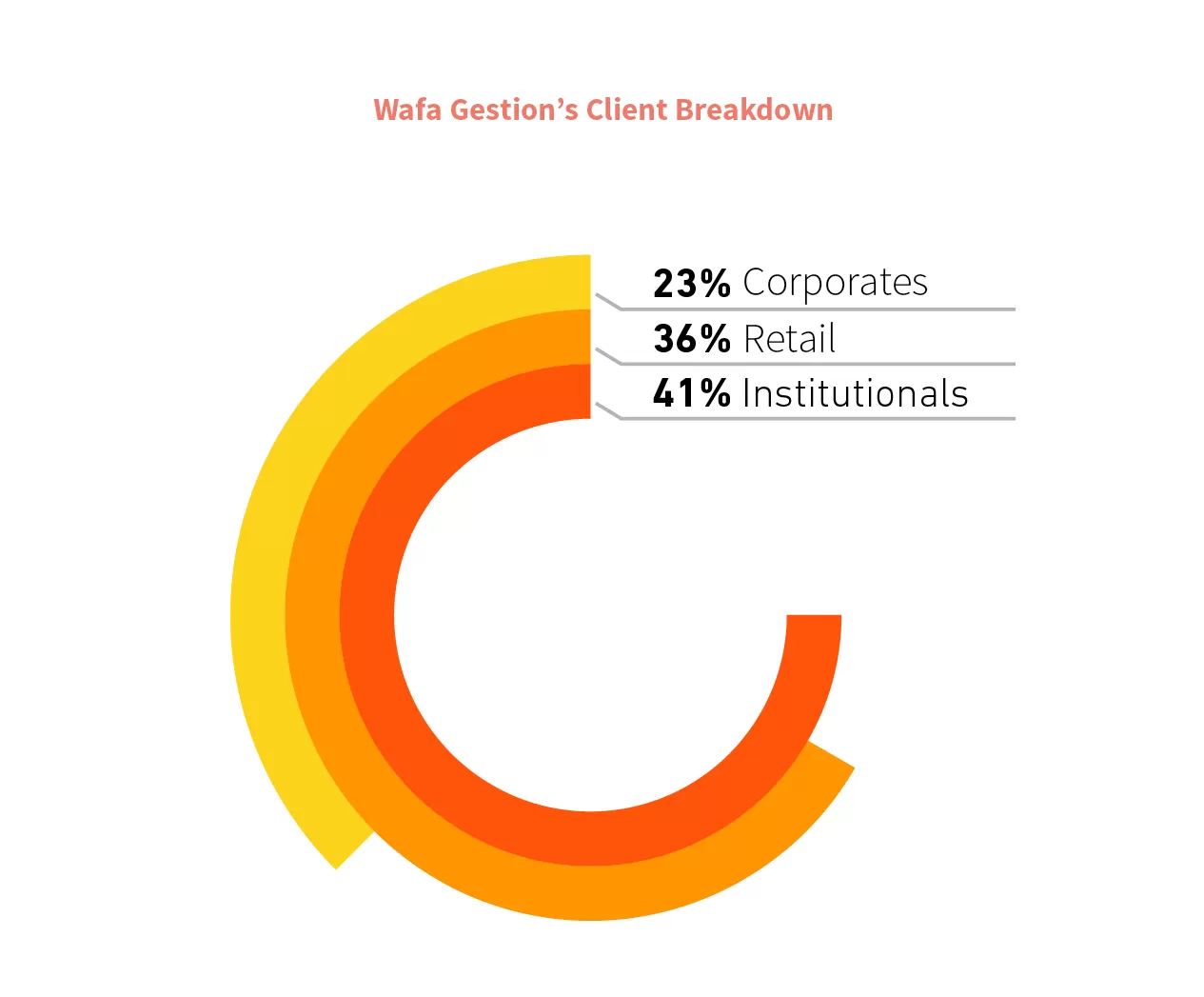

Breakdown per client type

Almost 100 funds under management, covering different asset classes and risk/return profiles.

Proximity and long term commitment to our cliens

Dedicated points of contact to help our clients define and select the investment solutions adapted to their objectives and risk profile.

Breakdown per client type

Almost 100 funds under management covering different asset classes and risk/return profiles.

Breakdown per asset class*

-

Medium-long term bond

-

Short term bond

* Wafa Gestion's outstanding as 13/02/2026

Proximity and long term commitment to our clients

Dedicated points of contact to help our clients define and select the investment solutions adapted to their objectives and risk profile.

Breakdown per client type

La Gestion d’Actifs a posé ses premiers jalons au Maroc en 1995 suite à la promulgation de la loi de 1-93-213 régissant les marchés financiers.

2024

Innovation: Launch of the Profil Flexible fund, a unit-linked investment solution invested in both equities and bonds

International presence: Wafa Gestion ranked by Forbes among the Top 15 largest asset managers in the MENA region

Awards: Wafa Gestion wins once again the LSEG Refinitiv Lipper Fund Awards for “Best asset management company in the MENA region over the last 3 years in the Mixed Assets Domestic Funds category”. The Attijari Diversifié fund was also named “Best Mixed Assets Conservative Fund over 10 years in MAD”.

Rating: Fitch Ratings confirms Wafa Gestion's “Excellent (mar)” rating

Brand: Wafa Gestion named “Best Asset Management Firm - Morocco 2024” by Global Brands Magazine

2023

Innovation: Launch of the first range of Factor Funds in Morocco, applying quantitative portfolio management strategies : Momentum, Low Volatility and Value

Wafa Gestion named Best Asset management company in the MENA region by the Refinitiv Lipper Fund Awards, in the 3-year Domestic Mixed Assets category

Fitch Ratings confirms 'AAAmmf(mar)' rating for Attijari Monetaire Jour and CDM Securite Plus money market funds

Event: Wafa Gestion takes part to the first Salon de l'Epargne edition in Morocco

2022

International presence : Wafa Gestion ranked by Forbes among the Top 10 largest asset managers in the MENA region

Innovation: Launch of the “Attijari Valeurs ESG” equity fund integrating Environmental, Social and Governance scores into the stock selection process

Fitch Ratings reconfirms Wafa Gestion's 'Excellent (mar)' rating

2021

Wafa Gestion ranked in the Top 5 of the 30 largest asset managers in the MENA region by Forbes

Fitch Ratings reconfirms Wafa Gestion's 'Excellent (mar)' rating

2020

Official launch of the Linkedin page

Deployment of the Business Continuity Plan from the start of the health crisis

Webinairs organized for customers

Wafa Gestion designated “Best Asset Management Company in Morocco” by the African Banking Awards 2020

Fitch Rating confirms Wafa Gestion's “Excellent (mar)” Investment Management Quality Rating (IMQR)

Fitch Rating confirms 'AAAmf(mar)' rating for two Wafa Gestion money market funds

2 Wafa Gestion funds awarded the prestigious Thomson Reuters Lipper Fund Awards in the Fixed Income and Multi-asset categories

2019

Wafa Gestion wins 4 prestigious Thomson Reuters Lipper Fund Awards 2019.

Fitch Ratings confirms Wafa Gestion's national Excellent (mar) Investment Management Quality Rating (IMQR)

2018

Launch of Attijari Dividend Fund, a distributing investment fund invested in equities listed on the Casablanca stock exchange, distributing a high dividend.

Launch of a new “Epargne Synphonie” solution in partnership with Wafa Assurance, covering savings products with unit-linked contracts backed by mutual funds.

Two of Wafa Gestion's mutual funds, in the multi-assets and fixed income categories, awarded the prestigious “Thomson Reuters Lipper Fund Awords 2019” prize.

2017

Launch of unit-linked savings insurance contracts backed by mutual funds;

2016

Wafa Gestion named “Best Asset Manager” by EMEA Finance magazine for the second year in a row

2015

Wafa Gestion named “Asset Manager of the Year 2015” by Global Investor and “Best Asset Manager” by EMEA Finance magazine

2014

ISAE 3402 Type I certification attesting to the compliance of Wafa Gestion's internal control system.

Fitch Ratings confirms Wafa Gestion's “Highest Standards (mar)” national rating.

2013

Two money market funds managed by Wafa Gestion rated “AAAmmf (mar)” by Fitch Fatings

Wafa Gestion named “Best Investment Management Company 2013” by World Finance (July/August 2013 edition)

2012

Launch of the first mutual fund invested in GOLD

2011

Launched of the Equity Savings Plan (Plan d'Epargne Actions)

Upgrade of Fitch rating from M2 to M2+.

2009

Reorganization of the UCITS range

2008

Launch of the market's first contractual mutual fund

2007

Obtention of the GIPS Certification

2005

Merger of Wafa Gestion, Attijari Management et Crédit du Maroc

2004

Banque Commerciale du Maroc (BCM) and Wafa Bank join forces to become the national leader in banking and finance

2003

First company to be rated: First Fitch Ratings rating awarded

2001

Launch of the first Humanitarian Funds

2000

Launch of the first Guaranteed Fund

1997

Launch of the first Fund of Funds

Obtention of the first AIMR certification

1996

Launch of Morocco's first two mutual funds

Launch of the first money market fund

Launch of the first Islamic fund

1995

Inception of Wafa Gestion

Title

Organization

Reda HILALI

Chief Executive Officer

Monsif GHAFFOULI

Chief Investment Officer

Nada GAZOULI

Marketing & Communication Director

Houssein BELCADI

Institutional & Corporate Clients Director

Taib MAATA

Retail & Private Clients Director

Adil BOULAL

Operations Director

Mohamed BERRADA

Internal Control, Compliance, and Ethics Director

Title

A customer-centric service model

We guide our clients in every step of the investment process

Investment solutions adapted to specific needs and constraints

A robust and bespoke portfolio construction process

A flexible offer and a high quality service

Title

Values and missions

Wafa Gestion is committed to providing each of its clients (institutional investors, corporates, retail and distribution networks) adapted, innovative and efficient investment solutions. Our shareholding structure (ATWB and Amundi groups) allows us to leverage a know-how and a market expertise, at national and international levels.

Ethics

We maintain the highest ethical standards towards our customers, our employees, our shareholders and the communities in which we operate. We act with integrity and exemplarity. We make promises that we know we can keep and we do so.

Excellence

Our clients are at the center of all our actions. We try to always exceed their expectations and even excite them. We take measured and adapted risks. We build long-term relationships with our customers and employees.

Leadership and Audacity

We cultivate audacity, that is to say: - Cultivate agility to adapt quickly to changes in our environment and always remain the market leaders - Dare to take initiatives, experiment and learn from our failures for a best collective performance